Sales Tax Calculator State Wise Online Tax Calculator

In this example, the total after-tax cost of the item is $216. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. But keep in mind you have to itemize your deductions to take the SALT deduction, and itemizing doesn’t make sense for everyone. A trusted tax pro, such as a CPA, or quality tax software can help you get clarity on your particular situation.

How to Solve Sales Tax: Step-by-Step Process

These records should include details such as the sales tax rate, the amount collected, and the total sale price for each transaction. Proper documentation aids in reporting and remitting sales tax to the state. Yes, sales tax is often applied to online purchases, especially if the seller has a physical presence in your state. Some https://www.bookstime.com/ states require tax to be collected on internet sales, while others do not. To make things even easier, we offer a Sales Tax Calculator that quickly calculates the total price of an item including tax. Simply enter the price of the item and the applicable tax rate, and the tool will give you both the sales tax and the total cost.

FAQ: Sales Tax Calculation

- You must collect sales tax if your business has a presence in a state that imposes sales tax.

- To make things even easier, we offer a Sales Tax Calculator that quickly calculates the total price of an item including tax.

- The due date is generally the 20th or later in the month following the reporting period.

- For example, if an e-commerce store sells over $100,000 worth of products in Texas, it may be required to register for sales tax in that state.

- For example, if the state tax is 4%, the county tax is 1% and the city tax is 2%, then the grand total tax charged to the customer will be 7%.

- Sales taxes are collected by the seller at the time of purchase, and are passed on to the government.

This ensures you’re using the correct rate for your specific area. When paying and filing your sales taxes, ensure you’re keeping up with sales tax rates and obligations and set reminders for when you need to file. When selling online, businesses may still need to charge sales tax, also known as internet sales tax. Businesses that sell taxable goods or services must get a sales tax license from the appropriate state and charge sales tax. As a small business seller, it’s your responsibility to ensure you collect the correct tax amount and pay it to the state.

By Zip Code

- The rate can also vary depending on what types of goods and services you sell, and what type of industry you’re operating in.

- For Shopify merchants using a sales tax tool for Shopify, like the TaxJar Sales Tax Calculator, such breakdowns are handled directly without rework.

- With simple math formulas that convert the sales tax percentages into decimals or multipliers which are applied to the price either by multiplication or by division.

- This method applies to any transaction, whether it’s a small retail purchase or a large business sale.

- To determine your sales tax nexus, you should check with the tax authorities in your state, a tax specialist or an accountant.

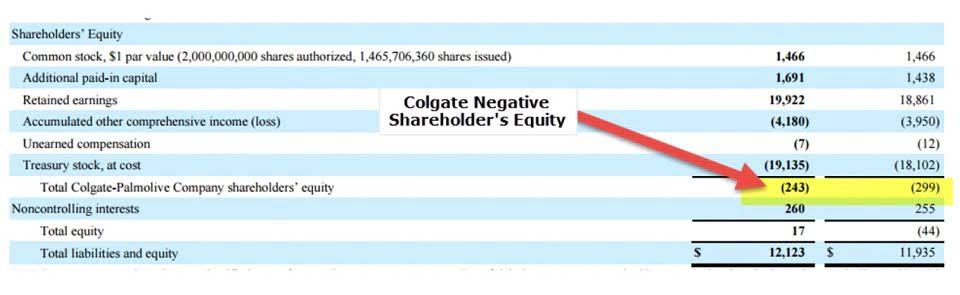

Sales tax is just one of many taxes that help raise income for QuickBooks state and local governments, and allows them to provide public services. To figure out how much sales tax you’ll be charging, simply multiply the original price by 0.05. Collect an additional $31.92 from the customer for sales tax. The customer’s total bill with sales tax is $430.92 ($399.00 + $31.92).

We recommend consulting a qualified professional for expert guidance. Calculoonline.com is not responsible for any errors or omissions in the calculations or misuse of the results. You’ll skip the tax and may score extra savings from retailers offering holiday discounts to attract more how to calculate sales tax shoppers. Some states may offer sales tax holidays throughout the year to minimize the burden on necessary purchases like school or disaster preparation supplies. A sales taxmultiplier will allow you to quickly calculate the final amount a customer willpay.

Enhanced pleasure at Betcoinfox digital casino plus rewards.

اشترك في النقاش